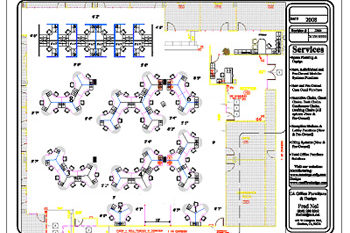

Conference & Meeting Room Options

Conference & Meeting Room Options Unnecessary meetings are the worst part of any workday, but unfortunately, they cannot be avoided altogether! For the meetings that do need to happen, having them in a conference or meeting room that is well-designed, and outfitted with the correct tools, can make a big difference when trying to get…